Ins and Outs of PayPal Deposits

PayPal has become one of the most widely used online payment platforms, offering convenient ways to send, receive, and store money digitally. One of PayPal’s key features is the ability to deposit money into your PayPal account from linked bank accounts, debit cards or credit cards.

While deposits can be quick and easy with PayPal, there are also some downsides to weigh regarding fees, transfer times, fraud protection and more. Examining the pros and cons allows you to make informed decisions when linking accounts.

Speed of Deposits with PayPal

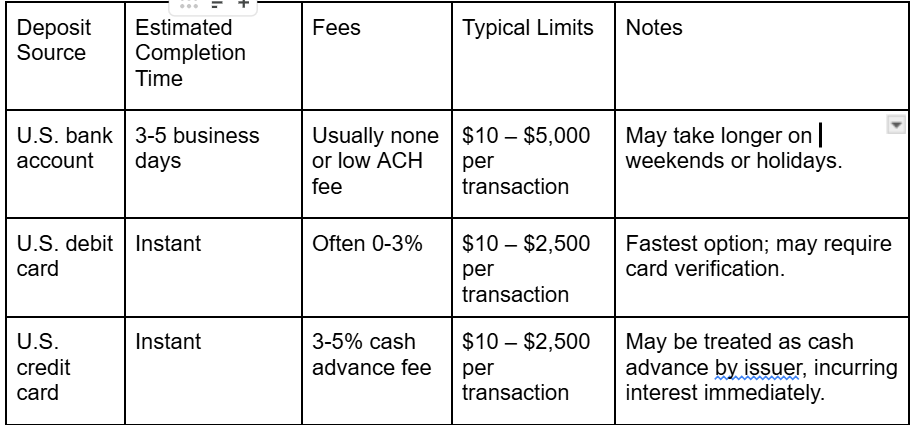

One of the main advantages of using PayPal for deposits at B7 Casino Nederland is the potential to have funds available quickly in your PayPal balance. Transfer completion times can vary depending on source and type:

As shown, debit card and credit card deposits are generally instant, while bank account (ACH) transfers take longer due to processing through the traditional banking system.

PayPal notes that some deposits may be briefly pending for review, but that most complete within minutes or hours. For eligible accounts, PayPal also offers an “Instant Transfer” feature to speed up bank account deposits for a fee.

PayPal Deposit and Withdrawal Fees

Another consideration is that certain deposit sources or withdrawals incur fees, reducing your overall balance. PayPal fee structures can be complex, but some typical charges include:

- ACH Transfers: No fee for standard 3-5 day deposits from bank accounts. Instant Transfers cost 1% with a $10 USD cap.

- Debit Card Transactions: No deposit fee, though withdrawals incur a fee after the first one per month.

- Credit Card Funding: PayPal charges a 2.9% + $0.30 fee for depositing from credit cards.

While you aren’t charged for basic debit card or ACH deposits, PayPal makes up costs on the back end if you later withdraw funds from those sources. It’s important to factor fees into account usage habits.

Protection From Fraud or Unauthorized Charges

PayPal states that they carefully analyze deposits and withdrawals for signs of fraudulent activity. This can add a layer of security:

- Suspicious deposits may be briefly pending for review before clearing. This limits fraud exposure from bogus deposits.

- Purchase and billing dispute resolution allows you to potentially recover unauthorized credit card charges.

However, there are still vulnerabilities to consider, like debit card spending that offers limited fraud protection compared to credit cards with $0 liability policies. Or bank account numbers that could be misused if obtained by bad actors.

As with any financial account linkage, closely monitoring transaction histories remains vital, even with PayPal security measures in place.

Weighing the Trade-Offs of PayPal Account Funding

Ultimately, there are compelling reasons on both sides to integrate or avoid PayPal deposits and withdrawals from personal accounts. Convenience and faster transfers favor linking debit cards, bank accounts and applying for PayPal credit cards. Yet fees, fraud liability, and loss of control over funds temper those benefits for some users.

Carefully assessing your money movement preferences, tolerance for withdrawal costs, and desired account protections can clarify the best approaches. In many cases, a blended methodology works well – keeping a nominal PayPal balance topped up via ACH, limiting credit card deposits, and handling larger transfers directly through traditional financial institutions.

Finding the right equilibrium comes down to honestly evaluating priorities and downsides when integrating PayPal into your broader financial ecosystem. Their two-decade tenure securely handling billions in digital transactions suggests the infrastructure is reasonably sound – but approach deposits and withdrawals conscious of the implications.