Self-Exclusion Programs Explained

Around 1% of adult gamblers worldwide experience severe gambling-related problems, according to the World Health Organization. Self-exclusion programs were introduced to help players voluntarily block access to gambling platforms and regain control over their play. These systems are now mandatory for licensed operators under regulators like the UK Gambling Commission and the Malta Gaming Authority.

Self-exclusion programs combine technology, legal enforcement and psychology to provide players with a structured break. They are a cornerstone of responsible gambling efforts, offering a balance between entertainment and safety. Understanding how they work, what tools they offer and how they differ globally helps both players and operators maintain ethical standards.

How Self-Exclusion Works at Licensed Casinos

At TeaSpins, players can request temporary or permanent self-exclusion directly through their account settings. Once activated, the casino locks access to games and prevents deposits for the chosen period. This process is irreversible until the exclusion period ends, ensuring players cannot change their minds impulsively.

Self-exclusion can range from 24 hours to several years. During this period, the operator must remove the player from promotional mailing lists and block any login attempts. Licensed casinos are legally required to comply with these rules, and failure to do so can result in heavy penalties — in some cases exceeding €500,000, as seen in UKGC sanctions in 2023.

Third-party databases also help reinforce these measures. For instance, GAMSTOP in the UK and Spelpaus in Sweden synchronize player bans across all licensed platforms. This means that even if a player tries to register with another casino, the exclusion remains in force.

Main Types of Self-Exclusion Programs

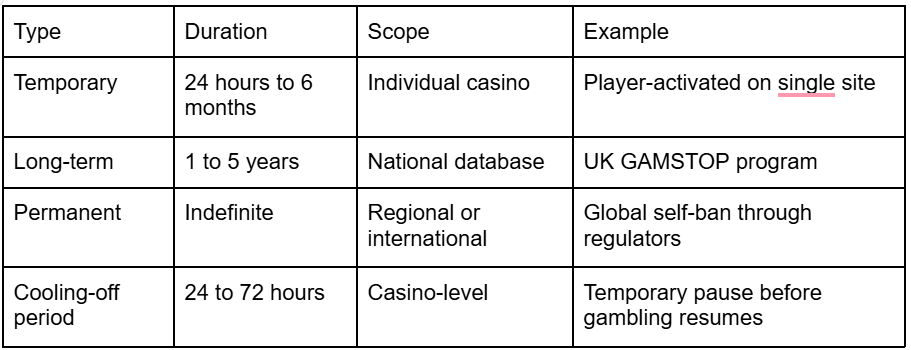

There are several forms of self-exclusion depending on the scope, jurisdiction and duration. The most common types are shown below.

Temporary exclusions are ideal for players who need short breaks after long sessions. National-level systems like Spelpaus, on the other hand, prevent gambling across all operators within a jurisdiction, offering a complete digital detox.

Technology Behind Modern Exclusion Systems

Modern self-exclusion programs rely heavily on AI and data verification tools. When a player registers for exclusion, the system cross-references personal information like ID numbers, email addresses and device fingerprints. This prevents duplicate accounts and bypass attempts.

In the European Union, data protection laws such as GDPR ensure all player information used in exclusion systems is stored securely and only shared with licensed operators. For example, in the Netherlands, the CRUKS register (Centraal Register Uitsluiting Kansspelen) automatically blocks players across both land-based and online casinos once their details are added.

AI-driven monitoring systems can detect behavioral changes even before self-exclusion is requested. If a player’s activity spikes in frequency or spending, the system might recommend voluntary exclusion or provide information about support services.

Support Services Linked to Exclusion

Self-exclusion isn’t just about blocking access; it’s part of a wider support network. Players who activate exclusion are often directed to counseling services such as GamCare in the UK, GambleAware or the National Council on Problem Gambling (NCPG) in the United States.

In Malta, the Responsible Gaming Foundation collaborates with local operators to offer phone hotlines and confidential consultations. These programs are funded by mandatory contributions from licensed casinos. For instance, the MGA requires operators to allocate at least 0.5% of gross gaming revenue to responsible gaming initiatives, including therapy partnerships.

Such integrations ensure that players don’t just step away but also receive professional help during recovery.

Global Differences in Regulation and Enforcement

While most major gambling jurisdictions enforce self-exclusion, the implementation varies widely.

- United Kingdom: All online casinos licensed by the UKGC must integrate GAMSTOP. The system covers more than 270,000 self-excluded users as of 2025.

- Sweden: Spelpaus, managed by Spelinspektionen, applies to every operator — from online slots to sports betting — under a national identity number.

- Australia: The BetStop system was launched nationwide in 2023, connecting more than 150 operators across states.

- United States: Self-exclusion operates state by state. New Jersey’s list, for instance, includes both physical and digital casinos under a unified framework.

These regional systems are gradually moving toward interoperability. European regulators are exploring cross-border exclusion networks to prevent players from switching between countries with looser restrictions.

Operator Responsibilities and Compliance

Casinos have strict duties when managing self-excluded accounts. Operators must ensure all associated accounts, marketing channels and loyalty programs are disabled. Automated checks monitor logins and payment activity to detect any breach attempts.

Audits are common. In 2024, the UKGC fined one operator €850,000 for failing to remove self-excluded users from promotional emails. Similarly, the Malta Gaming Authority suspended a license after repeated non-compliance with self-exclusion protocols.

Responsible operators often go beyond the minimum. Some add real-time behavioral tracking, offering voluntary deposit limits or time reminders that precede full exclusion. This layered approach has become a best practice standard for online gambling platforms.

Tools and Options for Safer Gambling

Self-exclusion works best when paired with other responsible gaming tools. These include:

- Deposit limits: Players can cap daily, weekly or monthly deposits.

- Reality checks: Pop-up reminders display playtime duration.

- Loss limits: Caps restrict total losses per session.

- Session timeouts: Automatic logouts after a set period.

- Access to account history: Lets users track betting patterns.

Many of these tools are mandatory under modern licensing regulations. For example, operators under the UKGC must provide deposit limits and time alerts as default features. Combining these mechanisms with self-exclusion ensures a comprehensive protection system.