Role of Fintech in Online Gambling

Fintech solutions have made transactions faster, more secure, and increasingly accessible. In the first quarter of 2025, transaction processing times in online casinos decreased by 78% compared to traditional banking methods used just three years ago. Furthermore, a recent survey by GambleTech Analytics found that 91% of online gamblers now prefer fintech payment solutions over conventional banking methods when engaging with betting platforms.

Key Fintech Innovations Reshaping Online Gambling

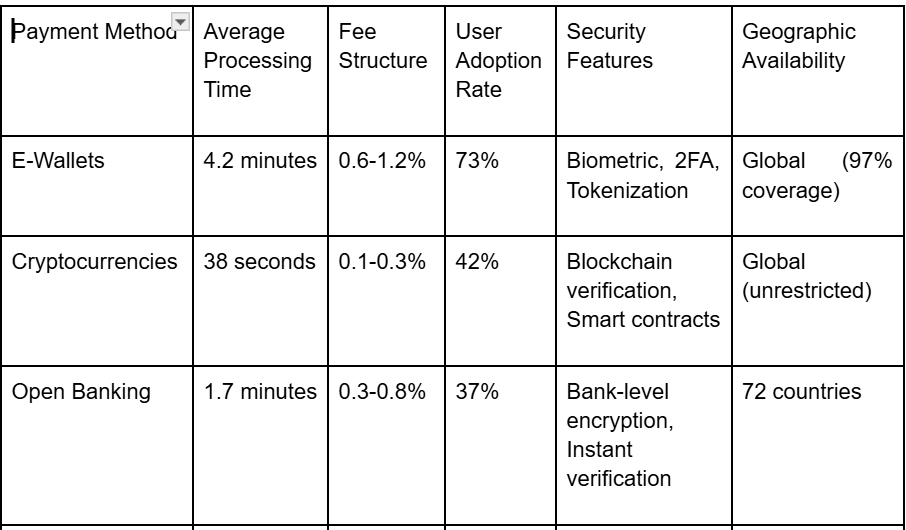

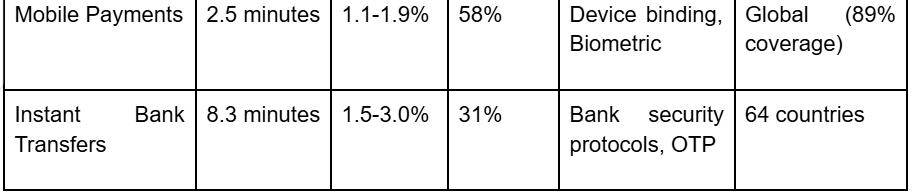

E-wallets have become the dominant payment method at Casino Spindog, with 73% of all transactions processed through these platforms in 2025. Services like PayPal, Skrill, and newer entrants like BlitzPay have captured significant market share by offering instant deposits and withdrawals. BlitzPay, launched in late 2024, has already processed over $8.4 billion in gambling transactions by April 2025.

Digital wallets have simplified the payment process considerably. For example, the average time to complete a withdrawal has decreased from 3-5 business days with traditional banking to just 4.2 minutes using advanced e-wallet solutions. Moreover, transaction fees have dropped from an average of 2.8% to just 0.6% for regular users.

Cryptocurrency Integration

Cryptocurrencies have moved from being a niche payment option to a mainstream solution in online gambling. By May 2025, 42% of all online casinos worldwide offer cryptocurrency payment options, up from just 17% in 2022. Bitcoin remains the most accepted digital currency, but platform-specific tokens have gained significant traction, with gambling-focused cryptocurrencies like BetCoin and GamblePro showing 312% growth in the first quarter of 2025.

The benefits are substantial – cryptocurrency transactions offer enhanced privacy, reduced fees, and in many cases, faster processing. For example, the average blockchain confirmation time for gambling transactions has decreased to just 38 seconds with new layer-2 solutions implemented specifically for gambling platforms.

Security Enhancements Through Fintech

Fintech has dramatically improved security in online gambling. Advanced KYC (Know Your Customer) protocols powered by AI have reduced identity fraud by 92% since their widespread adoption in late 2024. Additionally, biometric verification methods like fingerprint scanning and facial recognition are now used by 83% of major online gambling platforms.

In 2025, multi-factor authentication has become standard practice, with 94% of online casinos requiring at least two verification methods before processing withdrawals over $200. This has resulted in a 76% reduction in unauthorized account access compared to 2023 figures.

Responsible Gambling Tools Powered by Fintech

Perhaps the most significant contribution of fintech to online gambling has been in promoting responsible gaming. Advanced algorithms now track betting patterns and flag potentially problematic behavior in real-time. According to data from the International Gambling Regulation Association’s 2025 report, these systems have helped identify at-risk players with 89% accuracy.

Fintech solutions also enable:

- Automated deposit limits that adjust based on player behavior and financial capacity

- Cooling-off periods triggered by algorithm-detected problematic patterns

- Financial integration with banking apps to provide reality checks on spending

- Real-time budget notifications and warnings when approaching preset limits

A recent study by Harvard’s Digital Addiction Research Center found that casinos implementing these fintech-powered responsible gambling tools saw a 43% reduction in problem gambling incidents among their user base.

Comparative Analysis of Fintech Payment Methods in Online Gambling

Regulatory Challenges and Solutions

The rapid evolution of fintech in gambling has presented regulatory challenges. In response, 38 countries have updated their gambling regulations in the first half of 2025 specifically to address fintech integration. These updates focus primarily on:

- Data protection requirements for financial information

- Cross-border transaction monitoring

- Anti-money laundering (AML) protocols specific to cryptocurrency

- Responsible gambling controls tied to payment methods

The European Gambling Authority’s new Digital Finance Framework, implemented in February 2025, has established a standardized approach for fintech integration in online gambling across 27 European nations. This framework has reduced regulatory compliance costs by 47% for operators while strengthening consumer protections.

What’s Next for Fintech in Gambling

By late 2025, industry analysts predict that 35% of online gambling platforms will offer embedded financial services beyond simple payment processing. These include micro-lending for deposits (with strict responsible gambling controls), specialized gambling credit scores, and rewards programs integrated with banking services.

Decentralized Gambling Platforms

The rise of fully decentralized gambling platforms operating on blockchain technology is accelerating. These platforms processed $14.2 billion in wagers in Q1 2025, representing a 218% increase year-over-year. Their primary advantage is transparency – all bets and outcomes are recorded on public blockchains, allowing players to verify the fairness of games.